How important is personalisation in banking?

Today’s tech-savvy consumers expect tailored banking experiences. They care about their financial well-being and see their bank as an enabler for other aspects of their lives.

New challenger banks are understanding the demand of the digital world and are focused on improving experiences using personalisation, digital offerings and more competitive pricing. Yet still, surprisingly, 94% of incumbent banks are still not delivering on the ‘personalisation promise’.

Driving ongoing customer engagement

Understanding each customer at an individual level is key in order to form an ongoing, trusting relationship.

Many banks are exploring multi-channel communications to transform themselves from ‘legacy banks’ to ‘engagement banks’ but new entrants have built their systems on machine learning and AI, leapfrogging their competition to be ‘customer-centric banks’.

For all banks, it’s essential that they put processes in place that identifies each customer and the touchpoint they’re currently at. No matter where they are in the journey, the same service should remain. Something not all banks are successful in doing.

Technology in banking

Only 6% of banking firms claim that they’re advanced in terms of personalisation maturity – in other words, this 6% are deploying intelligent personalisation to their consumers.

Many of these incumbents are faced with time consuming, resource-heavy projects when making a change to their digital offerings, which makes it a challenge.

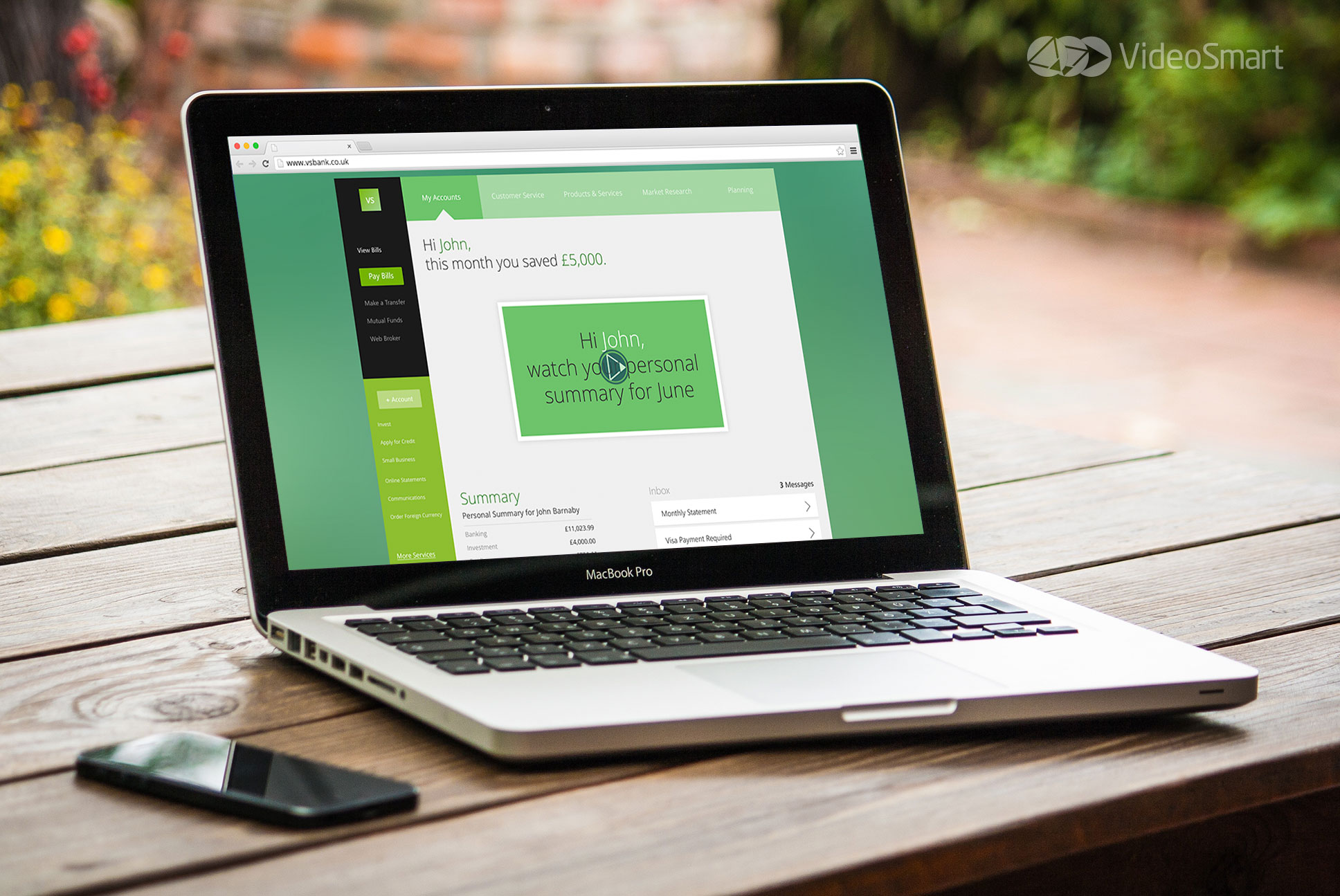

VideoSmart’s automated technology allows clients to introduce personalised and dynamic video communications as BAU, with very little work required from the bank itself.

Data is processed and analysed in order to identify customer behaviours and communicate with them with content that is relevant at that time.

Have a customer who just doesn’t respond well to e-mail comms? VideoSmart will detect this and revert to SMS. Still not successful? Print reversion ensues.

All of this with no input from the Client.

What’s more, VideoSmart’s interactivity enables clients to discover more about each customer by allowing them to choose their own journey, call-to-action or select products that are of most interest to them – giving the customer what they want and enriching data insights.

Customer desire for personalisation

90% of consumers see personalisation as very or somewhat appealing according to a recent Epsilon report and 80% of consumers say that they’re more likely to do business with a company that offers personalised experiences.

Customers want their banks to understand them and their needs. They want their banks to provide them with tailored solutions and speak to them in a voice that relates to them as one.

Where companies used to shy away from personalisation, customers now expect brands to use big data. This provides a great opportunity for financial services companies who have access to a huge amount of valuable transactional data.

Banks can analyse customer spend and deliver highly personalised recommendations. As such, banks can use personalisation to become trusted advisers by alerting customers of new products or important information at the right time.

For example, we know that a customer has just booked a holiday with their bank card, so let’s reach out to them about using their card abroad.

Personalised video in practice

In partnership with VideoSmart, NatWest became the UK’s first bank to deliver customer mortgage rates and payments using a personalised onboarding video.

Since then, RBS and NatWest have incorporated video into every touchpoint within the mortgage process, from approval in principle to completion on a new home, ensuring that their customers receive the same level of service throughout their cycle.

As well as aiming to better engage their customers, NatWest wanted to encourage customers to register for the online self-service portal to allow them to have more control over their banking.

Using interactive video content, customers are able to continue on their digital journey seamlessly, which 47% of viewers are in fact choosing to do.

Conclusion

By investing in the appropriate data analysis and technology, banks can boost customer experiences in real-time to drive loyalty, trust and additional revenue.

By doing so, they will ensure growth in a competitive market full of emerging challenger banks and banking apps.